Buying XPS insulation isn’t hard because it’s difficult to get a price. It’s hard because two offers that look identical on paper can behave very differently once the material hits a jobsite—thickness drifting, boards not staying flat, tongue-and-groove edges that don’t lock, corners that chip during unloading. Then the “cheap” order turns into slower installation, higher waste, rushed re-orders, and a lot of back-and-forth no one budgeted for.

The way to avoid that is simple, but not casual: lock the specification so quotes are truly comparable, ask for performance values tied to a standard and test method, confirm the supplier actually controls production, and treat lead time as a chain you can verify—not a promise you’re expected to trust.

This article walks through a practical, repeatable approach: how to define the spec, how to validate factory capability, how to judge quality by consistency (not a perfect sample), how to pressure-test lead time, how to compare total landed cost, and how to use a controlled first order to build a supplier relationship that stays stable when volume grows.

Lock the specification first, then ask for pricing

If the spec is vague, every quote you receive is basically a different product. Before you request a price, write down where the XPS will be used and what the board must do in that environment. Roof, wall, floor, foundation, under-slab, and cold storage all push the material in different ways. Floors and inverted roofs usually need higher compressive strength. Foundations and cold rooms punish weak moisture performance. Walls often expose problems with flatness, squareness, and edge quality because installers need clean joints and consistent thickness.

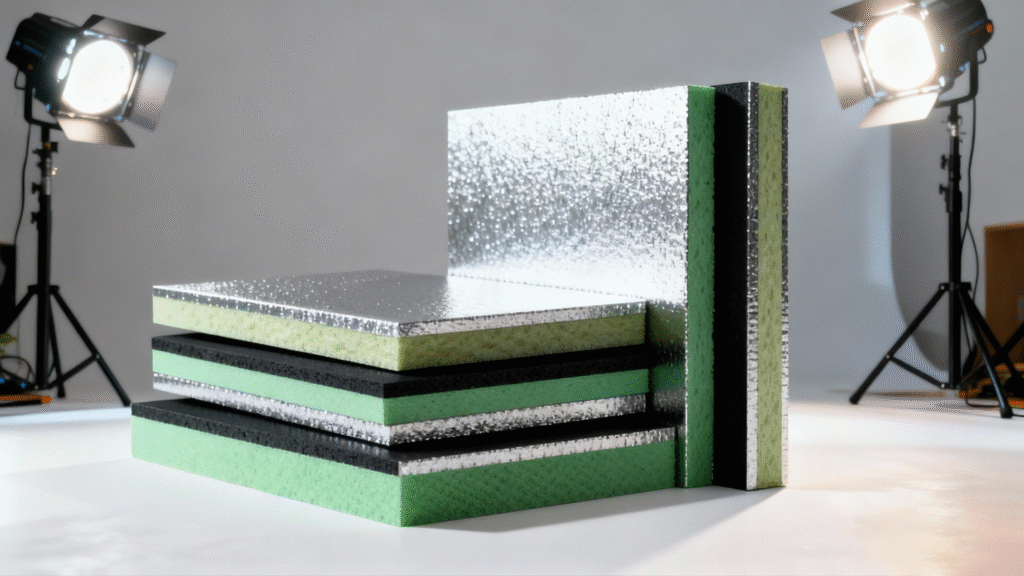

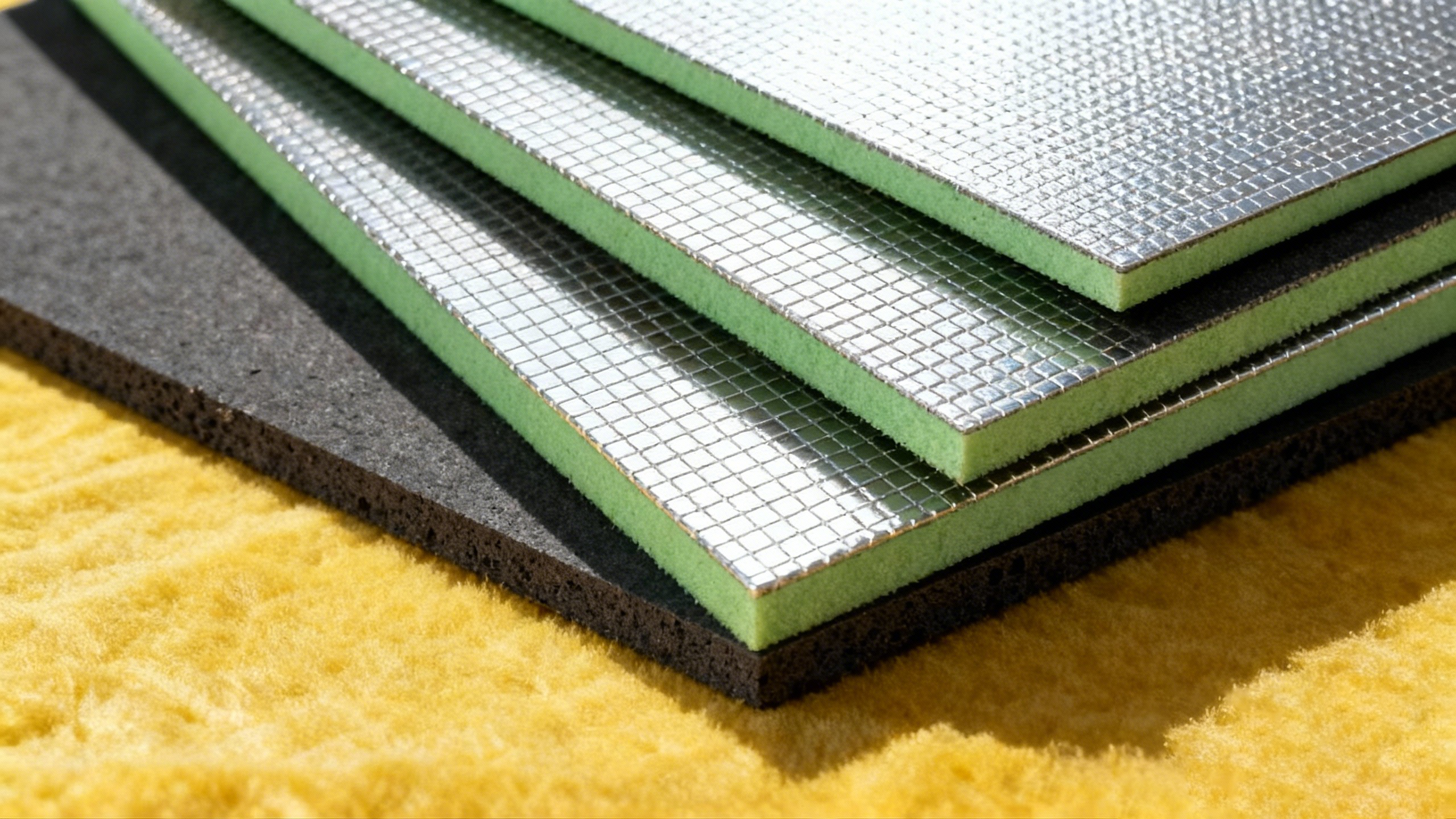

A usable spec includes thickness plus tolerance, density or grade, board dimensions, and edge profile. Edge type is not a “detail”; it affects how well joints close, how quickly installers move, and how much heat loss you get at seams. Ask suppliers to state the standard behind their numbers, typically ASTM C578 or EN 13164 depending on your market, and make sure thermal conductivity, compressive strength, water absorption, and dimensional stability are presented as declared values with a test method. When a supplier can’t tell you the test method, that “excellent performance” line on the data sheet doesn’t protect you on site.

Also decide packaging requirements early. XPS is light and easy to damage if packing is weak. Corner crush and edge chipping don’t just look bad; they create gaps, waste time, and increase material consumption when crews start trimming and patching.

Confirm you’re buying from a manufacturer that controls production

The quickest way to reduce risk is to make sure the supplier actually runs an XPS line and controls their process. A real manufacturer can explain, in plain language, how they control thickness and density during production, how they keep boards flat, and how they handle edge profiling and packaging. They can also show how batches are identified so quality issues can be traced and corrected instead of argued about.

Ask for simple, normal proof that matches factory reality: production line photos or a live video walk-through, a look at their cutting and packaging area, and an explanation of their inspection points from raw materials to final loading. You’re not asking for secrets. You’re checking whether they operate like a factory that ships every week, or like a trading office collecting brochures.

Capacity matters, but not in the way suppliers like to describe it. What you want to know is whether they can deliver your exact mix of thicknesses, sizes, and edge types without “moving your order” when something bigger comes in. If you need multiple SKUs, ask how they schedule changeovers and whether custom work affects lead time. The best manufacturers don’t promise miracles. They explain the plan.

Evaluate quality by consistency across boards and across batches

Many buyers get fooled by a “perfect sample.” One sample board can be hand-picked. Bulk orders show the truth. What causes problems in real projects is inconsistency: thickness drifting, density changing, compressive strength not matching the declared grade, boards arriving slightly warped, or edges that crumble during handling.

Ask for a technical data sheet that clearly states which values are declared and which are typical, and insist that test methods and standards are shown. Request recent test reports with dates. A clean PDF with no date, no test method, and no sample description is marketing, not evidence.

When you receive samples, treat them like a mini receiving inspection. Check flatness on a level surface, look at the edge profile for clean machining, measure thickness in multiple spots, and compare boards side by side for obvious variation. For projects where compressive strength is critical, sending samples to a local lab is often the cheapest insurance you can buy. A single failed floor area costs more than a lab report, and it usually turns into blame-shifting between the installer, the buyer, and the supplier.

Pay attention to cell structure and surface feel as well. Boards that look “fluffy” or show uneven texture can be a sign of unstable production settings. The jobsite symptoms are boards that dent too easily, edges that don’t stay crisp, and more breakage during unloading.

Treat lead time as a chain, then verify the weak links

Reliable lead time is not a promise; it’s a process. Every shipment depends on raw material availability, production scheduling, cutting and packaging time, inspection, documentation, container booking, port cut-off, and loading. When a supplier only gives you one number like “10 days,” you don’t know what’s actually included or what can break.

Ask them to explain their lead time in steps and tell you which steps change when you request custom size, custom color, or OEM packaging. Customization is usually doable, but it changes planning. Printing, artwork approval, packaging materials, and changeovers can add time, and honest suppliers will tell you that upfront.

Then ask for evidence that they ship on time, not just that they “can.” Recent loading photos, examples of packing lists with shipment dates, and a simple production schedule snapshot (with sensitive details hidden) are enough. Put the ship window in writing on the PI or contract and require early notice if anything slips. A professional manufacturer won’t be offended by this. They’ll recognize it as normal business, especially when your customer’s site schedule depends on that container leaving on time.

Compare total delivered cost, because the cheapest board often costs the most

Unit price is only one part of the cost. XPS that arrives with crushed corners, inconsistent thickness, or missing documentation creates hidden expenses fast: labor wasted on trimming and fitting, more adhesive or tape used to patch gaps, higher waste rates, delayed installation, and sometimes disputes with inspectors or clients.

A quote should state the full product definition and the delivery terms: thickness and tolerance, density or grade, board size, edge type, declared performance values with standards, packaging method, pallet type, labels, Incoterms, destination port, MOQ per SKU, lead time, and quote validity. If those details are missing, the price is not really comparable.

Also check how the supplier loads containers and how they protect the boards. Corner protection and tight wrapping are not “nice extras.” They reduce damage rates dramatically, especially on long routes or when cargo is handled multiple times. If you ship LCL, packaging matters even more because boards are exposed to more handling and shifting.

If your business depends on repeat orders, consistency is value. Stable thickness and predictable strength reduce claims, simplify your customer service work, and protect your brand reputation. Many buyers learn this the hard way after one “cheap” shipment turns into a month of emails and discounts.

Match the supplier to the right customer type, and build trust with a controlled first order

XPS is not a decorative material. It’s a performance layer in the building envelope, and if it fails, the cost shows up later in energy loss, moisture problems, cracked finishes, or structural complaints in load-bearing applications. That’s why the best supplier relationship is the one that treats documentation, traceability, and repeatability as part of the product—not as optional add-ons.

Working directly with a professional manufacturer is usually a strong fit for importers and distributors building a stable product line, contractors who need fast installation and low breakage, project owners who can’t afford site delays, and buyers in moisture- and load-critical applications like foundations, cold storage, and floors. It’s also a good fit for OEM buyers who need branded packaging and consistent appearance, because factories can control printing, labeling, and batch consistency when the requirements are fixed early.

The simplest way to build trust is not with big promises. It’s with a clean first order. Start with one or two core SKUs, confirm packaging and labeling, agree on what will be inspected at loading, and keep records that make claims straightforward if something goes wrong. After delivery, review real outcomes: breakage rate, thickness consistency, paperwork accuracy, and whether the shipment left on the date that was agreed. When those basics are solid, scaling up is easy and predictable.

Choosing an XPS manufacturer comes down to three buyer-critical outcomes: the product must be verifiable, delivery must be predictable, and any issues must be traceable. Start by locking the specification so pricing is comparable—thickness and tolerance, density/grade, dimensions, edge type, and the performance values that matter in your application. Require suppliers to state the applicable standard and test method, and separate declared values from typical marketing numbers. Next, confirm factory control: evidence of real production and packaging operations, clear inspection points, batch identification, and an explanation of how they schedule mixed SKUs and custom requirements without pushing your order aside. Judge quality by consistency, not a hand-picked sample—board-to-board thickness stability, flatness, clean edge profiles, compressive performance, and packaging that reduces transit damage. Treat lead time as a chain and verify the weak links with documentation and loading evidence, then put the shipping window in writing. Finally, compare total landed cost, factoring in breakage, waste, rework, and delay risk—not just unit price. That’s how you select a supplier that stays reliable as volume scales.